Investment Process

To proceed to the Investment Process webpage, you MUST have read the Characteristics and Risks of Options Disclosure Document. If you have NOT read this document, click on the “No” button and you will be directed to read this document online, or you may call PTI at 800.821.4968 to request a hard copy.

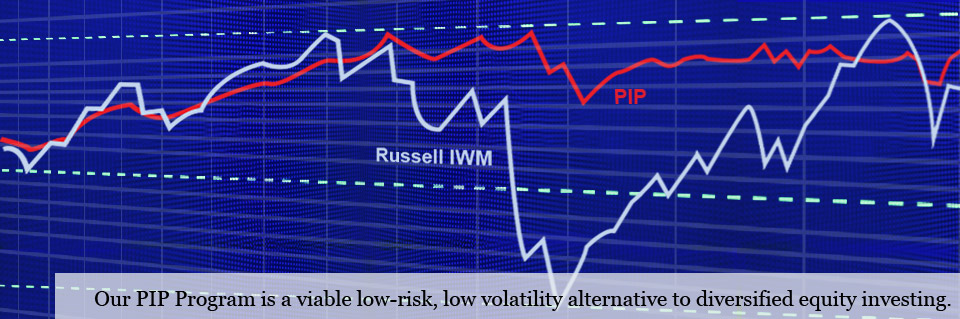

PTI has a strategy to achieve diversification in customer accounts of even modest amounts through the use of exchange traded unit investment trusts. These trusts trade like individual stocks all day, but really are trusts containing the entire basket of stocks making up a particular index. For example, the SPY, or Spiders, is a basket of all the stocks making up the S&P 500. The IWM is a basket of all the stocks contained in the Russell 2000. In one trade we can achieve the diversification that is otherwise very difficult to achieve in individual customer accounts. We look to further the diversification process by using a blend of the SPY, IWM or other diversified ETFs. With ETFs, the exact components are always known, and there are no hidden tax issues.

The second issue evident by the recent stock market history is the need for some level of protection either from general market declines or random shocks like the events of September 11. It becomes painfully obvious by talking to wide groups of investors that not enough analysis and hedging of market risk was undertaken by the average investor. The question was not asked or answered often enough “How does your portfolio look and how would your life-style change if Cisco was to go back to $15 per share?” Despite repetitions of tired clichés like “I am in for the long haul,” or “I don’t worry about the price, I am a buy and hold guy,” most investors are not happy with portfolio declines of much more than ten percent.

Money Management Principals

Thomas P. Haugh

Title: Chief Investment Officer

Years With Firm: Since 1991

Education: BA – Notre Dame University, MBA – University of Chicago

Registration: Series 3, 4, 7, 24, 53, 63 and 65

Daniel J. Haugh

Title: President

Years With Firm: Since 1991

Education: BBA – Notre Dame University, MBA – DePaul University

Registration: Series 3, 4, 7, 24, 27, 63 and 65

Robin Spitalny

Title: Money Manager / VP

Years With Firm: Since 1991

Education: BBA – University of Michigan, MBA – Northwestern University

Registration: Series 4, 7, 24, 63 and 65